Last week, the United States and Ukraine signed a long-awaited minerals deal, with Washington gaining access to Kyiv’s mineral resources in exchange for establishing an investment fund. The fund will be capitalized from future natural resource extraction, with Kyiv’s Economy Minister Yulia Svyrydenko saying the “full ownership and control” of the resources will stay with Ukraine. The agreement covers all sub-soil resources, including Ukraine’s oil and gas. The agreement also stipulates that future American military assistance to Ukraine will count as an investment into the joint fund, rather than being considered as reimbursement for past assistance. Previously, Trump falsely claimed that the U.S. has provided military aid to Ukraine worth $350 billion since Russia’s invasion in February 2022, with the Kiel Institute for the World Economy saying the actual figure is closer to $120 billion. Among the key sticking points of the initial deal was the question of security guarantees, with Trump initially refusing to offer any. Ukrainian President Volodymyr Zelensky rejected the initial draft agreement, describing it as asking him to “sell” his country.

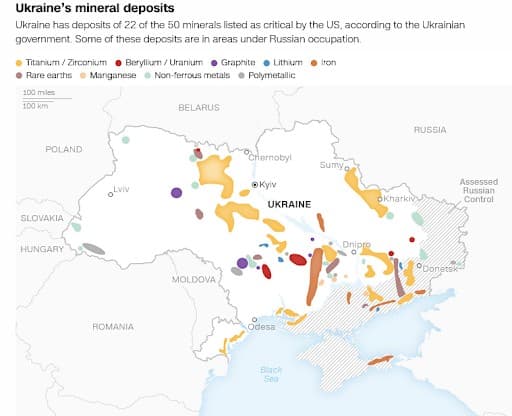

On the surface, the latest mineral deal appears beneficial to both countries, with the U.S. gaining access to Ukraine’s 22 rare earth minerals while Kyiv gets a long-term commitment for U.S. investment in "a free, sovereign, and secure Ukraine". Ukraine is home to substantial deposits of rare earths, including lithium, graphite, manganese, zirconium, iron and various non-ferrous metals.

Source: CNN

However, Washington is unlikely to see a quick payback. Ukraine's deputy prime minister Yulia Svyrydenko posted on X that the jointly-owned Reconstruction Investment Fund is not likely to pay out any dividends in the first 10 years. And, she’s probably right.

The economic viability of Ukraine’s critical minerals is currently unknown, with even the best-mapped Novopoltavske field last surveyed more than three decades ago. The field is located just north of Chernihiv in Zaporizhzhia province, the wrong side of the front line. The same case applies to two of the touted lithium projects.

Related: Trump: Low Oil Prices Put U.S. In Good Negotiating Position With Russia

Indeed, ~40% of Ukraine's critical mineral resources are under Russian occupation, meaning that unlocking the full value of the minerals deal will not be possible in the absence of definitive reconciliation of Ukraine's and Russia's territorial claims.

Further, Ukraine’s existing production facilities were not included in the minerals deal with the U.S., meaning Ukraine will essentially have to build a production and supply chain from scratch in a lengthy and capital-intensive process. Ukraine has no capacity to process and refine rare earths, with China having a hegemony in global rare earths processing.

On a more positive note, Ukraine's graphite deposits are relatively well mapped and on the right side of the front line. According to the Ukrainian Geological Survey, the Balakhivske project is currently at the feasibility study stage. Even better, Ukraine will have a ready European market for its graphite.

Unfortunately, Ukraine will have to contend with China’s price wars in this sector. Canadian miner Northern Graphite Corp (OTCQB:NGPHF) recently announced plans to mothball its Quebec plant after graphite prices collapsed 50% due to an oversupply from China. China controls 70% of the global graphite supply, and is able to swap out smaller competitors by flooding the markets. Indeed, China is largely to blame for the rare earth crash and the Shanghai benchmark index declining nearly 70% from the peak in February 2022 after Beijing issued unusually huge quotas to miners.

Rare earth prices surged to their highest level in a decade in 2022 thanks to consolidation in China, inflationary pressures and lingering pandemic effects. However, the REE selloff kicked off in earnest in 2023 due to increased production in China, slower-than-expected demand growth and a weak Chinese economy. That coincided with a period of increasing production across the globe, with the U.S. Geological Survey reporting that rare earths production climbed 10% in 2023, surpassing demand growth. Praseodymium oxide prices in China fell 37% in 2023 and another 26% in 2024 while terbium oxide and neodymium oxide sank to their lowest levels since 2020.

That said, the Trump administration has just made its first strategic move in the pivotal critical minerals sector. And, more is coming: Washington is pushing the Democratic Republic of Congo and Rwanda to sign a peace accord, accompanied by mineral deals.

"The (agreement) with the D.R.C. is at a much bigger scale, because it's a much bigger country and it has much more resources, but Rwanda also has a lot of resources and capacities and potential in the area of mining as well ... not just the upstream, but also midstream and downstream to processing and refining and trading," Massad Boulos, Trump's senior advisor for Africa, told Reuters last week.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com

- OPEC+ Stuns Market With Larger Than Expected Output Hike

- OPEC+ Plans Faster Rollback of Output Cuts

- Morgan Stanley Slashes Brent Oil Price Forecast to $62.50